Canada

Country Overview

The Canada Revenue Agency (CRA) publishes a broad selection of technical publications and other helpful information relating to excise duties on beer products under the Excise Act and on cannabis, spirits, tobacco, vaping, and wine products under the Excise Act, 2001.

Product Consumption Analysis

Growth Analysis Estimated Stamps Volume Period: 2019 - 2024

| Estimated Stamps Volume | ||||

|---|---|---|---|---|

| Product Type | 2019 | 2024 | CAGR | Volume in |

| Beer | 4,700M | 4,187M | -2.28% | Millions |

| Cider and perry | 77,190K | 78,569K | +0.35% | Thousands |

| Cigarettes | 1,145M | 662M | -10.38% | Millions |

| Fine-cut tobacco | 18M | 9M | -12.85% | Millions |

| Ready to drink | 346,191K | 687,503K | +14.71% | Thousands |

| Spirits | 221,763K | 233,955K | +1.08% | Thousands |

| Wine | 822M | 855M | +0.80% | Millions |

Summary by Product Category

| Estimated Stamps Volume | ||||

|---|---|---|---|---|

| Category | 2019 | 2024 | CAGR | Volume in |

| Alcoholic beverages | 6,167M | 6,043M | -0.41% | Millions |

| Tobacco | 1,163M | 671M | -10.41% | Millions |

| TOTAL - Canada | 7,330M | 6,714M | -1.74% | Millions |

Detailed Yearly Data

2024 (7 products)

| Product Type | Total Volume | Legal Volume | Illicit Volume | Estimated Stamps | Pack/Bottle Size |

|---|---|---|---|---|---|

| Beer | 2,094M | - | - | 4,187M | 0.500L |

| Cider and perry | 58,927K | - | - | 78,569K | 0.750L |

| Cigarettes | 20,054M | 13,246M | 6,808M | 662M | 20 sticks/pack |

| Fine-cut tobacco | 357M | - | - | 9M | 40 sticks/pack |

| Ready to drink | 302,502K | - | - | 687,503K | 0.440L |

| Spirits | 175,467K | - | - | 233,955K | 0.750L |

| Wine | 641M | - | - | 855M | 0.750L |

2019 (7 products)

| Product Type | Total Volume | Legal Volume | Illicit Volume | Estimated Stamps | Pack/Bottle Size |

|---|---|---|---|---|---|

| Beer | 2,350M | - | - | 4,700M | 0.500L |

| Cider and perry | 57,892K | - | - | 77,190K | 0.750L |

| Cigarettes | 32,429M | 22,908M | 9,520M | 1,145M | 20 sticks/pack |

| Fine-cut tobacco | 709M | - | - | 18M | 40 sticks/pack |

| Ready to drink | 152,324K | - | - | 346,191K | 0.440L |

| Spirits | 166,322K | - | - | 221,763K | 0.750L |

| Wine | 616M | - | - | 822M | 0.750L |

Tax Stamp Programs

Cannabis

Stamp Specification:

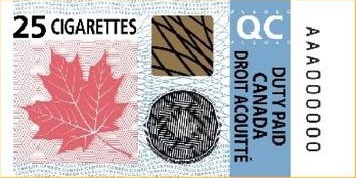

Cigarettes

Stamp Specification:

Fine-cut tobacco

Stamp Specification:

Other tobacco products

Stamp Specification:

Raw leaf

Stamp Specification:

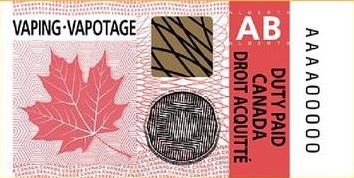

Vaping devices

Stamp Specification:

History

The Canada Revenue Agency (CRA) evolved from early customs and excise departments, becoming Revenue Canada in 1994 by merging separate tax and customs entities, then transforming into the Canada Customs and Revenue Agency (CCRA) in 1999 for greater efficiency, before officially becoming the Canada Revenue Agency (CRA) in 2005 after customs duties shifted to the Canada Border Services Agency (CBSA), focusing the CRA on tax administration and benefit delivery. Key Milestones:

- 1927: The Department of National Revenue Act formed the Department of National Revenue, combining Customs and Excise and creating a separate income tax department, both under one minister.

- 1994: Revenue Canada was created by merging the separate Customs and Excise and Taxation departments for administrative consolidation.

- 1999: The Canada Customs and Revenue Agency (CCRA) was established as an agency (not a department) to improve service and efficiency, incorporating customs and tax functions.

- 2003: Customs operations were separated from the CCRA to form the Canada Border Services Agency (CBSA).

- 2005: The agency's name officially changed to the Canada Revenue Agency (CRA), solidifying its focus on tax and benefits.

Purpose:

- Initially focused on collecting duties and customs, its role expanded to include administering Canada's growing tax system and delivering social programs.

- Today, the CRA's primary mandate is enforcing tax laws, collecting federal and provincial taxes, and delivering benefits to Canadians.